If you’re applying for a mortgage, you may have come across the terms Tax Calculations, SA302 and Tax Year Overview. These documents play a crucial role in the mortgage application process, especially if you’re self-employed or receive rental income. But what exactly are they? Why do lenders ask for them? And how can you get hold of them? Let’s break it down.

What Are Tax Calculations (SA302s) and Tax Year Overviews?

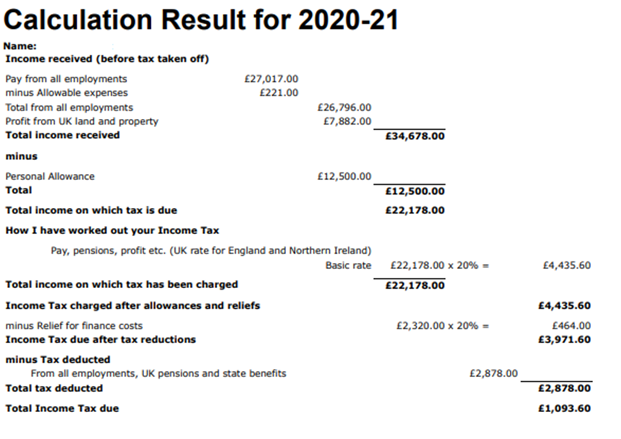

A Tax Calculation (also called SA302) is a document issued by HM Revenue & Customs (HMRC) that summarises your income and the tax you’ve paid for a particular tax year. It’s essentially a snapshot of your tax return, showing your earnings and tax liability after all calculations have been made.

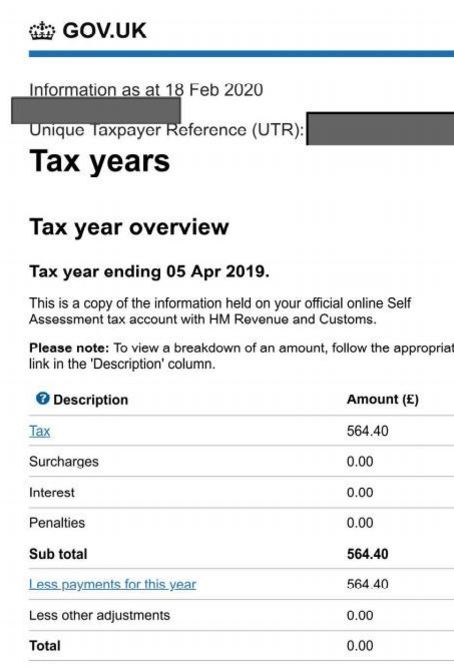

A Tax Year Overview is an official document provided by HMRC that summarises your tax position for a specific tax year. It shows the total amount of tax due, how much has already been paid, and whether there is any outstanding balance.

What is the difference between a tax return (SA100) and a tax overview?

A tax return shows all the client’s income details, including a return for any employed income submitted to the inland revenue. This will evidence the declared turnover, gross profit, expenditure, salary, etc. A tax overview, on the other hand, shows how much tax has been paid within the tax year.

Both documents serve as official proof of your income and tax history, which mortgage lenders rely on to assess your ability to repay the loan.

Do I need to declare rental income on my tax return?

Yes, you must declare any rental income on your tax return! The profit earned from this income source will be shown on the tax calculations under “income from land and property”.

Why Do Mortgage Lenders Need These Documents?

When you apply for a mortgage, lenders need to verify your income to decide how much they can safely lend you. For employed individuals, this usually involves payslips and P60s. However, if you’re self-employed or have irregular income, it can be more challenging to prove your earnings.

This is where SA302s and Tax Year Overviews come in. They provide lenders with a trusted, government-issued record of your income over the past few years, giving them confidence in your financial stability. Without these documents, your mortgage application could face delays or even rejection.

How Can You Obtain Your SA302 and Tax Year Overview?

There are several ways to get these documents from HMRC:

1. Online via your HMRC online account

- Visit the HMRC website and log into your personal tax account.

- Navigate to ‘Self Assessment’ and select ‘More Self Assessment Details’

- You can view and download your SA302s and Tax Year Overviews for the relevant years.

You can get up to four years’ worth of information. Also – if you’re in a hurry – you’ll need to wait 72 hours after submitting your tax return before you can download your SA302.

2. Request by Phone

- To request an SA302 or Tx year Overview by phone, you need to contact HMRC’s Self Assessment helpline on 0300 200 3310.

- When calling HMRC, be prepared to provide some information to verify your identity and facilitate the request, such as your National Insurance number, your Unique Taxpayer Reference (UTR), details of the tax year(s) for which you need the SA302 and any other information that may be required to confirm your identity.

Once your request is made, HMRC will process it and send the Tax Calculations and/ or Tax Year overviews to your registered address. The processing time can vary, so it is advisable to request the form well in advance.

3. Via Your Accountant

If you or your accountant submitted your Self-Assessment tax return by paper, you will be automatically sent your SA302 in the post.

if you or your accountant uses commercial software to perform your Self-Assessment tax return, you’ll need to use that software to access your proof of earnings or print your SA302s and Tax Year Overview from your HMRC online account.

Final Tips:

- Always ensure you have at least the last two to three years’ worth of SA302s or Tax Year Overviews, as most lenders typically require this period to fully assess your income.

- Have these documents ready before you start the mortgage process to avoid delays.