Are you looking to take a dream holiday this summer? Or do you have plans to get the garden ready to enjoy the sun? Whether you want to renovate your home, support your family, or manage debts, there are several ways to release money from your property.

This fact sheet breaks down three common options. Plus, we’ve included real-life examples to help you understand how each one works. But don’t forget, this is just a guide. We’ll go through your own circumstances in a discovery meeting to find the specific option for you.

1. Equity Release (Lifetime Mortgage)

- Best for: Over-55s who want tax-free cash without monthly repayments.

- How it works: Borrow money secured against your home; no monthly repayments needed. Interest builds and is repaid when you pass away or move into long-term care. You still own your home and can choose to ring-fence inheritance.

- Example: Margaret (68) wanted to gift £25,000 to help her granddaughter buy her first home. She used a lifetime mortgage to release equity from her home without affecting her lifestyle. There are no repayments, and the loan plus interest will be repaid when the property is sold in the future.

2. Secured Loan (Second Charge Mortgage)

- Best for: Borrowers who want to keep their existing mortgage deal.

- How it works: Take out a second loan secured on your property, in addition to your existing mortgage. Ideal if your current deal is on a low interest rate.

- Example: Tom and Priya needed £40,000 to renovate their kitchen and add a home office. Their existing mortgage was on a low fixed rate with years left. Instead of remortgaging and losing that deal, they used a secured loan alongside it.

3. Capital-Raising Remortgage

- Best for: Borrowers looking to switch deals and release funds.

- How it works: Remortgage your home for a larger amount than you currently owe. The extra money is released as a lump sum.

- Example: Jake and Olivia had £120,000 remaining on their mortgage and wanted £30,000 for debt consolidation and home upgrades. They remortgaged to a new deal worth £150,000, clearing credit cards and reducing their overall monthly outgoings.

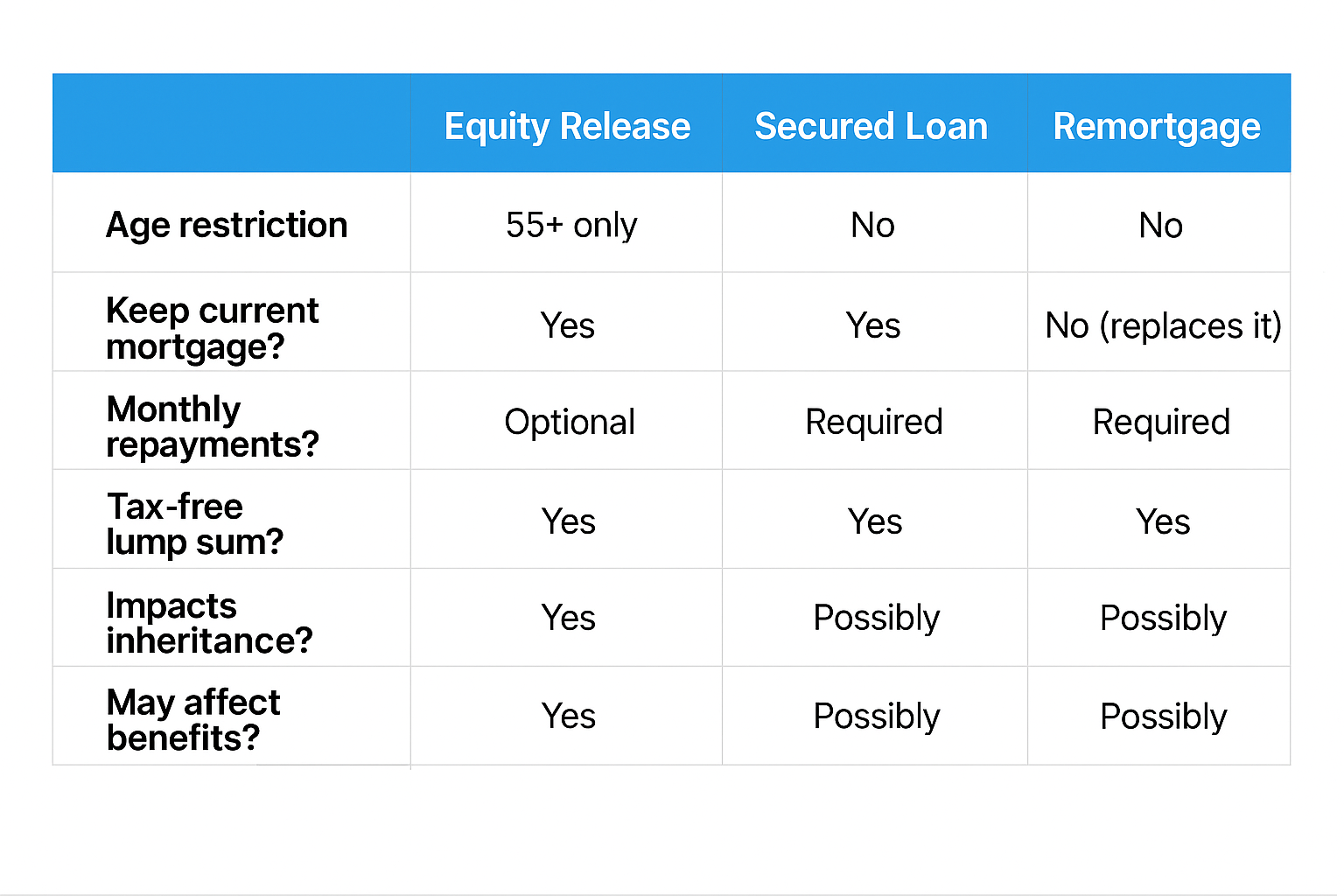

Each of these options has pros and cons depending on your age, mortgage status, and financial goals. It’s important to consider your lifestyle. Do you need repayments now or later? Will this affect family inheritance or your benefits? Are you keeping or changing your current mortgage?

You’ll need regulated advice before making any decisions, especially with equity release. So let’s book in a discovery meeting to help you find the most suitable option for your personal needs.

SPEAK TO AN ADVISER

This is a lifetime mortgage. To understand the features and risks, please ask for a personalised illustration. Check that this mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice. Your home or property may be repossessed if you do not keep up repayments on your mortgage or any other debts secured on it. A fee may be charged for mortgage advice. The exact amount will depend on your circumstances.

January is often a time for reflection and forward planning. For homeowners in later life, it can al...

Read More >

January is often when people take a step back and look at their finances with fresh eyes. Once the f...

Read More >

January is often seen as the month for fresh starts. We declutter our homes, reset routines and take...

Read More >

Delivered by Chancellor Rachel Reeves on 26th November, the 2025 Autumn Budget brings a mix of new c...

Read More >

The festive season can be magical. But honestly, we are speaking to so many of our clients, and the ...

Read More >

Big news from the mortgage world: Nationwide are releasing interest-only mortgages to first-time buy...

Read More >