Equity release gifting is a great way to release tax-free cash from your home to help friends and family. Recent research conducted by Later Life Lender more2life reveals the true extent to which gifting via Equity Release can benefit fund recipients.

When those over 55 access equity locked up in their homes to gift their children, or even grandchildren, they open the opportunity for young first-time buyers to secure lower Loan-to-Value options on their first mortgage, essentially meaning they can secure lower rates saving them money in the long term.

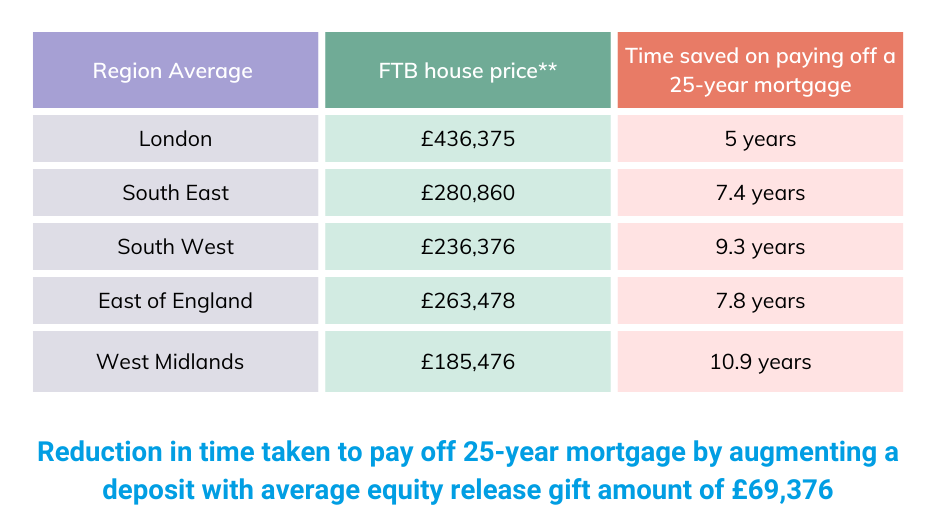

This saving could equate to as much as half the span of a mortgage without gifting in areas such as the North of England, while even in the UK areas with the highest house prices – in London – a first-time buyer could save 20%, or five years, allowing them to start putting increasing savings of their own towards other expenses.

The equity release provider used data from the Land Registry's** most recent UK House Price Index to find the average amount of money paid by a first-time buyer across all UK regions. It then used a mortgage calculator to work out the average financial cost over two and five years for a mortgage purchased at a standard fixed rate 90 per cent LTV over 25 years.

To calculate the possible savings unlocked by an equity release enhanced gift, more2life added the £69,376 lump sum to the first-time buyer’s initial deposit, which changed the LTV and both slashed the mortgage’s lifetime cost and the time spent paying the capital borrowed to the lender.

To discuss how you could release cash from your home via an equity release/Lifetime mortgage product, get in touch with us today.

GET IN TOUCH TODAY

This is a lifetime mortgage. To understand the features and risks, ask for a personalised illustration. Check that this mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice. A fee may be charged for mortgage advice. The exact amount will depend on your circumstances.

Source:

*https://www.mortgagesolutions.co.uk/news/2022/07/27/gifting-equity-release-could-cut-five-years-from-ftb-mortgage-more2life/

**https://www.gov.uk/government/news/uk-house-price-index-for-may-2022